Content

When a product or unit is sold, it needs to be packed and shipped and if a commissioned salesperson was involved, there will be sales commissions due. Operating costs are expenses companies incur during normal operations. Operating expenses include all of the expenses that aren’t covered under cost of goods sold, such as rent, equipment, and marketing. As these costs do not directly relate to production or sales volumes, they are generally fixed — or semi-fixed — and listed on the company’s income statement as indirect costs. Often, the objective of a company’s cost-reduction strategy is to lower costs in this category.

To calculate a total SG&A figure for an annual income statement, you’ll have to go through your company’s books for that year and add up all of the non-COGS, interest or income tax expenses you see there. SG&A costs are reported on the income statement, the financial statement that your business prepares to figure out how profitable it is. SG&A expenses are the indirect costs of operating the business day-to-day. Selling expenses included in SG&A are often divided into direct and indirect costs.

Some other examples of costs are rental equipment as long as they are not related to manufacturing or sales. On an income statement, SG&A and any other related expenses are listed below the gross margin. Once she calculates the SG & A beforedepreciation, she deducts the depreciation of the office building, the depreciation of the office equipment, and the depreciation of the vehicles. The net $356,550 is the amount that will be reported on the income statement. Cost of Service includes every expense that directly relates to the service you provide.

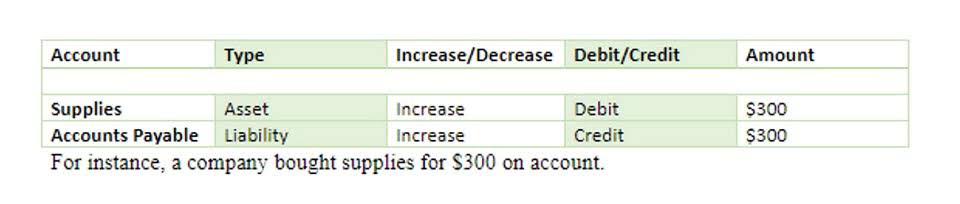

Recording SG&A in your accounting books

Understanding where you’re spending money is the first step in making strategic decisions (e.g., should you spend more on social media advertising next month?). Depreciation is also reported on its own line item under operating expenses. Any costs related to manufacturing or sales would not be a part of SG&A. How much a company spends on their SG&A actually plays a huge role in their profitability, or net income. Our business benchmarking approach examines efficiency and effectiveness not just within the sales and marketing function but also with a view toward the impact across your enterprise. Then, we use proprietary process benchmarking methodology to quantify your gap to world class – comparing your sales and marketing function’s ability to execute efficiently and effectively .

A sales commission agreement is signed to agree on the terms and conditions set for eligibility to earn a commission. Discover the products that 31,000+ customers https://www.bookstime.com/ depend on to fuel their growth. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- By looking at the SG&A of each company, duplicated employees and positions can be identified and cut.

- Some fixed costs, such as office rent, may be quite predictable.

- Both tax professionals help with tax planning and advising clients in complicated tax situations, but there are some key differences.

- The percent-of-sales method for allocating SG&A costs can be especially troublesome when sales of one product line constitute a very small percentage of total sales.

- SG&A expense represents a company’s non-production costs in selling goods and running daily operations.

- Direct selling expenses are incurred when a unit of a product or service is sold.

- As part of that review, it looked at how the company’s accountants were calculating SG&A expenses for each of the corporation’s major product lines.

What top management learned was that the OEM market was more profitable than had been assumed. Up to that time, the company’s accounting staff had been using the percent-of-sales method for allocating SG&A expenses to each of the manufacturing divisions. Some division managers were dissatisfied with the result, among them the vice president of the television division. He complained that his division’s SG&A charge was inflated because his product line used high-cost finished components—picture tubes and cabinets. Confronted with intensifying foreign and domestic competition, the senior management of an electronics company decided to review its manufacturing and nonmanufacturing costs. As part of that review, it looked at how the company’s accountants were calculating SG&A expenses for each of the corporation’s major product lines. Profits can be inflated and losses understated using broadbrush SG&A accounting methods.

How to List SG&A and COGS

Of its sales revenue, then that’s the percentage the company controller will charge to each product line based on its sales. Under the cost-of-sales method, the controller charges each product line an SG&A amount based on its share of manufacturing cost . To achieve better control over nonmanufacturing costs, manufacturing executives are developing more precise measures of their SG&A expenses. Many manufacturing companies, however, continue to make the mistake of relying on “one size fits all” methods of allocating SG&A costs. I have observed this process many times in the course of my work as a manufacturing cost consultant. It can be found in every industry and in companies that are well managed in other respects.

- This will tell you if you’re comparing companies on the same basis.

- Of its sales revenue, then that’s the percentage the company controller will charge to each product line based on its sales.

- The attention to detail, coupled with an understanding of and willingness to dig in to our unique systems and processes has kept us running smoothly.

- You might encounter a problem when you’re analyzing income statements from two firms in the same industry.

- Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends.

SG&A stands for Selling, General and Administrative expense and it basically covers every category of Cost of Goods Sold . Contact us to learn about The Hackett Group’s Sales & Marketing Benchmarking services. The attention to detail, coupled with an understanding of and willingness to dig in to our unique systems and processes has kept us running smoothly. We have found that the cost savings and efficiencies of working with a company like Owl is more beneficial than hiring our own in-house employee.

sg&a Management supports approval processes, capacity analysis and variance analysis. At CCH Tagetik, we are continuously updating our performance management software with innovations based on input from our customers to improve the customer experience. That’s why our customers rank us high in independent customer satisfaction surveys.

What Is the Difference Between COGS and SG&A?

GEP SMART is an AI-powered, cloud-native source-to-pay platform for direct and indirect procurement. Look for more detail and insight on cost component classification in the company’s financial statement footnotes. This will tell you if you’re comparing companies on the same basis.

When these expenses are deducted from the gross margin, the result is net income. Changes to your SG&A expenses should always tie back to specific business objectives. Since SG&A expenses are the cost of doing business, plan your budget accordingly to continue to meet your business goals. Lendio’s software can help you to track and categorize your expenses properly.

Selling Expenses

Allocating promotional costs posed no problem either because promotions were always carried out on an individual product-line basis. Although a conversion cost ratio is usually an improvement over the percent-of-sales method, it too has built-in distortions and therefore should be used with caution. If a company has certain product lines with a high percentage of finished components bought from vendors, those lines will incur much lower conversion costs. Their SG&A charges would be understated and their profitability inflated.

Direct expenses are those incurred at the exact point-of-sale for a product or service. Examples of direct selling expenses include transaction costs and commissions paid on a sale. Operating expenses and selling, general, and administrative expenses (SG&A) are both types of costs involved in running a company, and significant in determining its financial well-being.

What is Not Included in SG&A?

Monitoring your company’s SG&A can show you where you need to cut costs. If you’re struggling to keep profits up, make a profit, or notice an increase in expenses, you may need to decrease your SG&A costs. SG&A Expensesmeans selling, general and administrative expenses, as determined in accordance with GAAP. SG&A Expensesmeans the US GAAP calculation of selling, general and administrative expenses of the Borrower Group.

What is the difference between OpEx and COGS?

Operating Expenses Different? COGS vs. Operating Expenses comes down to how COGS are the direct cost of selling products/services while OpEx is the indirect costs not tied to revenue production.

Company ABC’s total selling, general, and administrative expenses for the period is $8,600. If you’re familiar with operating expenses, you might be wondering what the difference is between SG&A and operating costs.

A business has many expenses that are not directly related to making or selling a product. Office rent, utilities, and insurance all are costs of doing business. Departments like human resources and information technology support the business but do not take a direct role in product creation. Direct selling expenses are incurred only when the product is sold. They include shipping supplies, delivery charges, and sales commissions. Repairs and maintenance made to buildings, plant machinery and office equipment are classified as SG&A expenses, along with the depreciation of these assets. Salaries paid to employees who are not directly involved in manufacturing products or servicing clients are considered SG&A expenses.

Free Financial Statements Cheat Sheet

Indirect selling expenses – these types of expenses are usually generated either before a sale or after a sale. Examples include marketing expenses, web and social media expenses, and marketing, advertising and promotion costs. Base salaries paid to salespeople are included in indirect selling expenses because they are paid regardless if there is commission involved or not. Other types of expenses related to sales activity could include travel expenses, etc as well. SG&A includes most other costs related to running a business aside from COGS.

Enable digital transformation and drive strategy with all your financial processes and data in a unified platform — owned by Finance. Trusted clinical technology and evidence-based solutions that drive effective decision-making and outcomes across healthcare. Specialized in clinical effectiveness, learning, research and safety. The details of how SG&A expenses are calculated vary widely from company to company, so YCharts recommends looking at the annual report (10-k) an investor is interested in dissecting this number further. She is a Certified Public Accountant with over 10 years of accounting and finance experience. Though working as a consultant, most of her career has been spent in corporate finance. Helstrom attended Southern Illinois University at Carbondale and has her Bachelor of Science in accounting.

Note that SG&A excludes interest expense since interest expense is reported as a “non-operating” expense (i.e. non-core). From here, you can divide EBIT by revenue to calculate the operating margin. For companies implementing cost-cutting initiatives, the first area they look at tends to be SG&A as opposed to COGS. Sales CommissionSales commission is a monetary reward awarded by companies to the sales reps who have managed to achieve their sales target. It is an incentive geared towards producing more sales and rewarding the performers while simultaneously recognizing their efforts.

- Indirect selling expenses occur throughout the manufacturing process and after the product is finished.

- Other SG&A costs, such as shipping costs or sales commissions, will vary.

- Some division managers were dissatisfied with the result, among them the vice president of the television division.

- Other selling expense is indirectly related to the number of units sold.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

The amount that a company spends on SG&A may play a key role in determining its profitability. Selling, General and Administrative (SG&A) costs, also called operating expenses, are a company’s overhead costs that are not directly linked to production. These costs are essential for day-to-day operations and can include rent, utilities, office supplies, insurance, employee salaries and marketing expenditure.

Selling, general and administrative expense definition

Selling expenses include both indirect and direct business costs. The accountants, marketing professionals, and software engineers who keep the business running, and all of the office space, supplies, and utilities they use, are SG&A expenses. SG&A plays a key role in a company’s profitability and the calculation of its break-even point. That’s the point at which the company’s revenue generated and its expenses incurred are the same. Interest expense is one of the notable expenses not included in SG&A. She is an expert in personal finance and taxes, and earned her Master of Science in Accounting at University of Central Florida. Most accounting software programs can help you setup your operating expenses.

SG&A, an abbreviation of “selling, general & administrative”, is a catch-all category of expenses that is inclusive of spending that isn’t a direct cost, otherwise known as cost of goods sold . If the ratio of SG&A to sales revenue increases over time, it may become more difficult to earn a sustainable profit. Reducing SG&A lowers the level of revenue needed to earn a profit, which is why companies often focus on SG&A when attempting to cut costs. Corporate controllers must decide how far to go in breaking down SG&A expenses. It may not pay, for example, to count the number of phone calls made or salesperson hours spent in the field per account in allocating selling costs to a product line. Too much refinement may impose unjustifiable record-keeping costs. The controller requested managers in the different departments to calculate advertising, warehousing, selling, and other nonmanufacturing costs for the three market segments.

How should I control my SG&A expenses?

We specialize in unifying and optimizing processes to deliver a real-time and accurate view of your financial position. This is because it deals with all of the other factors that come with creating a product. Firms must often reduce SG&A costs through cost-cutting moves, such as employee layoffs, when they grow too large without a rise in sales. The same might happen when sales drop for a long stretch of time. Get your employees to use a dedicated receipt app to scan and keep track of all receipts.